- Trading is exciting as well as lucrative for those who take it seriously and approach it with the right mindset and attitude.

- But at times, it can be frustrating as well as a costly experience for many new traders, leaving them with little to show for their efforts.

- There are several broker studies that have been conducted, and they show that as many as 90% of the traders are expected to lose money in the markets.

- The rate might be even higher if we take day traders, forex traders, and options traders into consideration.

Common reasons for failure in the stock market

- There are many reasons for traders to lose their money in the stock market.

- It is said that 90% of the new traders lose 90% of their initial capital in the first 90 days of trading.

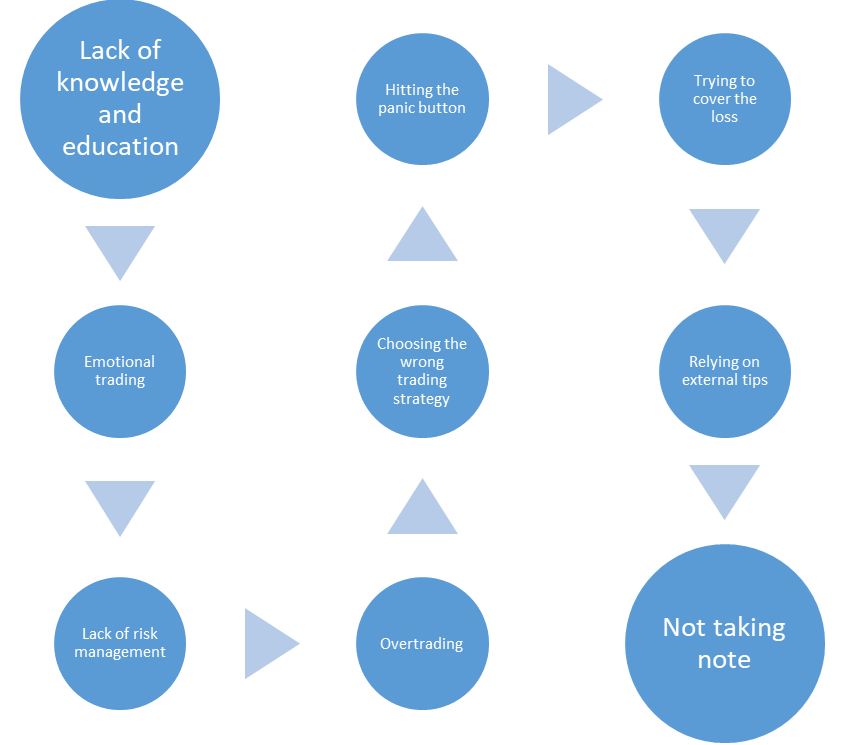

The main reasons for failure in the stock market are as follows:

Lack of knowledge and education:

- This is the biggest reason for traders to lose their money in the stock market.

- Many people think that trading is easy because it is believed that it is a quick way to make money without investing much time and effort.

- But this is a misconception.

- Trading is a professional endeavor, and it must be taken seriously like any other money-making venture.

- The main barrier to starting trading is very low, but the barrier to making a profitable trade is very high.

- To be a successful trader, you should have a proper understanding of the markets, how they work, and the different factors that can affect prices.

- To learn about the stock market, you can read books, attend seminars, take courses, and seek professional advice from experienced traders.

- New traders will require a profitable trading system with an edge before they even begin putting real money at risk.

Emotional trading:

- Another reason traders lose money is due to emotional trading.

Common emotions that affect trades are as follows:

- Fear can cause traders to panic and make rash decisions.

- Greed can lead them to take excessive risks and chase unrealistic gains.

- Hope will make the traders hold onto losing positions for too long.

- Regret can cause them to second-guess their decisions and also miss out on profitable trades.

- To avoid emotional trading, you should have a clear set of rules and guidelines in your trading style that you can follow regardless of how the market is behaving.

- This will include setting stop-loss orders, taking profits when the trade has reached a predetermined target, and avoiding impulsive trades.

- Many of the new traders lose because they can’t control the actions their emotions are causing them to take.

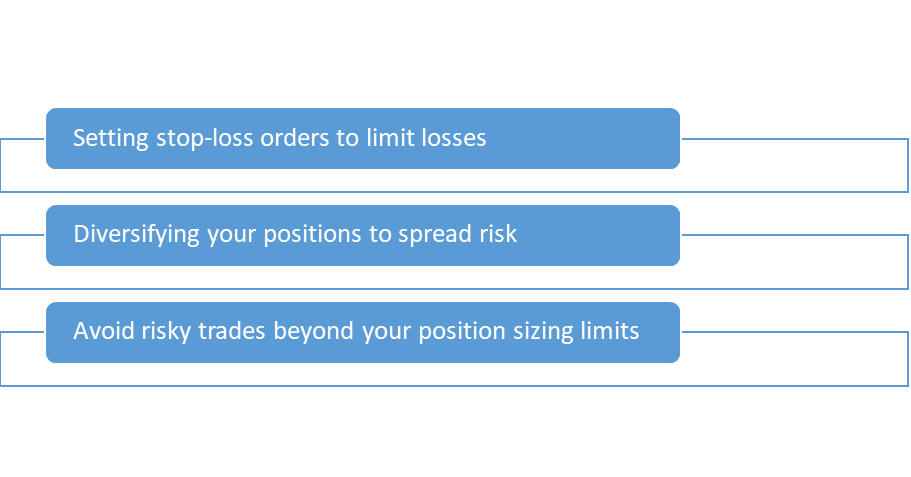

Lack of risk management:

- Another mistake is the lack of risk management.

- Trading is risky, so you will need a plan for how you will manage your risk.

This will include:

You should also have an understanding of risk tolerance and return goals before you start to trade.

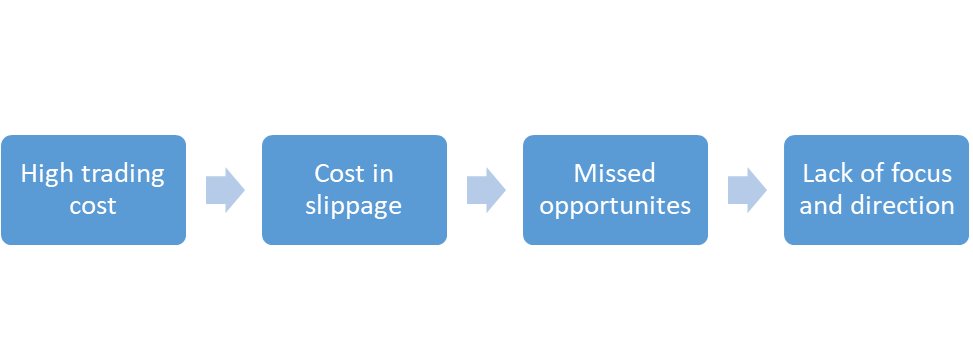

Overtrading:

- Overtrading is the biggest reason for high losses.

- This can happen when traders make too many trades based on emotions rather than following a carefully planned strategy.

Overtrading can lead to the following:

- To avoid overtrading, you should set up a clear trading plan outlining your strategy and the types of strategies that you will use.

Choosing the wrong trading strategy:

- Choosing the wrong strategy is one of the many reasons to lose money.

- There are many trading strategies, but not all will fit with your return goals, risk tolerance, or beliefs about the market.

- Many traders will fail to do so and will end up using a strategy that is not fit for them.

This can lead to the following:

- To avoid all these, you should conduct proper research and also choose a strategy that will align with your goals and personality.

Hitting the panic button:

- Many traders hit the panic button when the market becomes choppy.

- When you panic, you will compromise your profit, which will benefit the traders who don’t panic.

- Day trading will require a lot of courage and risk appetite so as to digest the ups and downs of the market.

Trying to cover the loss:

- When a loss occurs, day traders will try to cover the same and average out their position in a hurry.

- Traders end up overtrading, which will increase the risk level.

Relying on external tips:

- Relying on external tips to base the trading decision is the costliest mistake that you should avoid at all costs.

- You have charts to read and a stockbroker to give you trading tips, and this will pay you off in the end.

Not taking note:

- Day traders should note down all the trades and the reason behind the outcome review at the end of the day trading.

- This will be helpful as a ready-made reckoner for the future.

- This is a small step that will separate successful traders from others.

Conclusion

Trading is rewarding as well as lucrative and it can also be risky at times.

Frequently Asked Questions (FAQs):

Q1) What is the 90% rule in trading?

It is said that 90% of the traders lose 90% of their capital in the first 90 days of trading.

Q2) What is the first rule for successful trading?

Always using a trading plan is the most successful rule for trading.

Q3) What is the golden rule for traders?

Always prioritizing risk management is the golden rule for traders.

Q4) Which is the best trading strategy?

Day trading is the best trading strategy.

Q5) Is there a 100% trading strategy?

A 100% trading strategy may work well in certain market environments but will fail miserably in others.

About Us:

Nifty Trading Academy is our academy where we teach about the stock market as well as technical analysis. We also provide live trading sessions and upload blogs for them.