What is Share Market? The main function of the share market is to function as a source of capital for companies.

In a share market, shares are bought and sold. The stock market is a share market, however, besides shares of companies, other instruments like bonds, mutual funds, and derivative contracts too are traded in the stock market.

History of Share Market

- It was in 12th century France that the ‘Courretiers de change’ took on the task of managing and regulating agricultural communities' debt.

- This was on behalf of the French banks of that time. This group of men traded the debts and became known as the first brokers.

- It was in the middle of the thirteenth century in Venice, bankers started to trade in the government of Venice Spreading Stories. The idea behind this was to decrease the cost of Venetian government funds.

- In the large cities of Italy, including Pisa, Genoa, Florence, and Verona, bankers started to trade. This happened around the fourteenth century.

- Businesses and organizations in Italy were also the first to sell shares on the stock market.

- It was not until the sixteenth century that business in the United Kingdom was able to sell shares. Many other countries then followed.

Today, there are stock markets all over the world, The most well-known stock markets, and the world's largest area in the United States of America, as well as in the United Kingdom, China, Canada, India, Japan, Germany, France, Netherlands, and South Korea.

What is Share Market in India?

Earlier, stockbrokers would converge around Banyan trees to conduct trades of stocks. As the number of brokers increased and the streets overflowed, in 1854, they relocated to Dalal Street, the place where the oldest stock exchange in Asia – the Bombay stock Exchange is now located.

LEARN – What is NSE India | Indian Stock Market Basics | Moneycontrol Website

In 1993, the National Stock Exchange or NSE was formed. Within a few years, trading on both the exchanges shifted from an open outcry system to an automated trading environment.

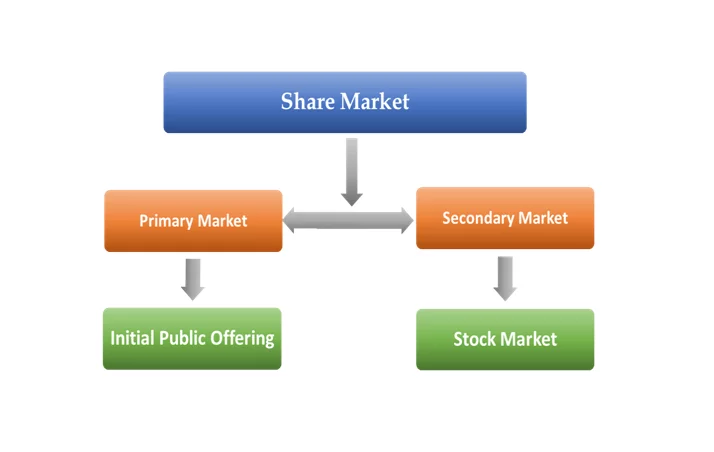

Primary and Secondary Market

There are two kinds of Share Market

- Primary Market

- Secondary Market

#1 Primary Market

- Primary Market is the market where investors can buy shares directly from the issuer company to raise their capital.

- When investors purchase securities on the primary capital market, the company offering the securities has already hired an underwriting firm to review the offering and create a prospectus outlining the price and other details of the securities to be issued.

#2 Secondary Market

- A secondary market is a market where stocks are traded after they are initially offered to the investor in the primary market and get listed on the stock exchange.

- The secondary market comprises equity markets and debt markets.

- It is a platform to trade listed equities, while the Primary market is the way for companies to enter into the secondary market.

How does Share Market work?

- The stock market works as investors buy/sell shares in publicly traded companies.

- There are interactions between the four groups of people that the stock market work.

- In the diagram below, we are the “Investors” and we only deal with the “Trading Participants”.

- However, for a complete understanding of the market, you need to understand the other relationships.

1. The Publicly Listed Company and The Stock Exchange

- The publicly listed company applies to the stock exchange so that they can be allowed to offer shares of stock to the public.

- The company must comply with very stringent requirements before the investments are opened to the public.

2. The Stock Exchange and The Trading Participant (Broker)

- The stock exchange does not directly transact with investors. Only Trading Participants licensed by the Stock Exchange are allowed to buy and sell shares of stock.

- This was done simply for control purposes and work simplification.

- The Stock Exchange prioritizes monitoring of publicly Listed companies while the Trading Participants deal with the investing public.

3. The Trading Participant and Investors

- You will have to contact a trading participant (broker) if you want to buy or sell shares of a particular company.

- For this, the broker will charge a very small fee for the buying or selling transaction.

- The broker also provides you with information on which companies are good to buy in addition to their transaction services.

How to Invest in Shares?

1. Know Your Investment

- The stock market has, perhaps, the most exciting investment opportunities for the investor community.

- Understand your investment requirements and limitations. Your requirements should take into account the present as well as the future.

- Making profits on short-term buying and selling of shares incurs capital gain tax. So, ensure that your cash needs don’t force you to sell your shares on short-term unnecessary costs in the future.

2. Make a Decision on Your Strategy

- To trade or invest successfully you need to understand your investment profile and analyze the stock market. After analyzing stock market, you can decide your investment strategy.

- Once you understand and follow your strategy with discipline you will get very good results.

3. Monitor Your Portfolio

- Keep updated with the latest happenings of the company and the industry. There is a number of factors that can affect the company which can be both domestic and international.

- Read the corporate announcements to remain updated with corporate actions of the company like new acquisition, merger, appointment or resignation of senior management etc. This information can also be found on the company’s Website.

- Ensure that you regularly read about the companies you have invested in. in case of some unfortunate situation, this will help you minimize your losses before it is too late.

If you are searching for What is Share Market in India, History of Stock Market in India then your search ends here!