- Nifty is the combination of the national stock exchange and fifty.

- It is the top stock market index on the national stock exchange.

- A stock market index is a statistical measure that will measure a particular segment or the overall performance of the stock market.

- Nifty 50 is tracking the performance of the top Indian blue-chip companies.

- These companies are the most traded as well as the largest in the country.

What is the meaning of Nifty?

- Nifty happens to be the largest stock market index on the NSE.

- It will include 50 leading companies that are traded on the NSE and are also chosen based on free-float market capitalization.

Investors are using Nifty for the following purposes:

- The Nifty index is owned by India Index Services and Products Limited (IISL).

- IISL is a fully owned subsidiary of the National Stock Exchange Strategic Corporation Limited.

How does Nifty work?

- The Nifty index consists of 50 stocks that are chosen from various sectors of the Indian economy.

- These stocks are selected based on the NSE's eligibility criteria, which include market capitalization, liquidity, trading frequency, and sector representation.

- The formula for nifty calculation includes a floating market capitalization-weighted methodology.

- Free-float market capitalization is the market value of the company’s shares that are available for trading in the open market.

- This will exclude the shares from the promoters, strategic investors, and the government.

- NSE will periodically review and adjust Nifty so as to ensure the changing market dynamics.

Eligibility criteria for the Nifty Index listing

There are many criteria that need to be fulfilled for the stock to appear on Nifty.

The following are the main criteria:

Domicile:

The company should be registered in India and have its stocks listed on the NSE.

Liquidity:

The stocks should have sufficient liquidity, and they must be traded for at least 90% of the trading days or six months before the index review.

Impact cost:

The impact cost of the stock should be less than or equal to 0.50% in the six months before the index review.

Market capitalization:

The market capitalization of the stock should be adequate enough to rank among the top 800 companies listed on the NSE based on average daily market capitalization six months before the index review.

Trading frequency:

The trading frequency of the stocks should be a minimum of 100% in the last six months before the index review.

This indicates that the stocks were traded during all trading days during that period.

Voting rights:

Companies should have stocks with differential voting rights (DVR).

10 stocks in the Nifty 50 index

Here, we are listing the top 10 stocks in the Nifty 50 index.

| STOCK NAME | STOCK PRICE |

| ASIAN PAINTS LIMITED | 2917.80 |

| BRITANNIA INDUSTRIES LIMITED | 5167.80 |

| CIPLA LIMITED | 1387.40 |

| EICHER MOTORS LIMITED | 4624.00 |

| NESTLE INDIA LIMITED | 2506.75 |

| GRASIM INDUSTRIES LIMITED | 2425.30 |

| HERO MOTORCORP LIMITED | 4481.60 |

| HINDALCO INDUSTRIES LIMITED | 619.35 |

| RELIANCE INDUSTRIES LIMITED | 2804.90 |

| HINDUSTAN UNILEVER LIMITED | 2380.10 |

How is Nifty calculated?

- The Nifty index is calculated through the free-float adjusted method and the market capitalization weighted method.

- This method refers to the market value of the company’s shares that are available for trading in the open market.

- This index or method will exclude shares that are held by promoters, strategic investors, and the government.

- For calculating the nifty through a formula, the calculation of the base year and value is necessary.

- This index has a base year and a base value to provide a reference point for measuring changes in its value over time.

- For the nifty index, the base year is 1995 and the base value is 1000 points.

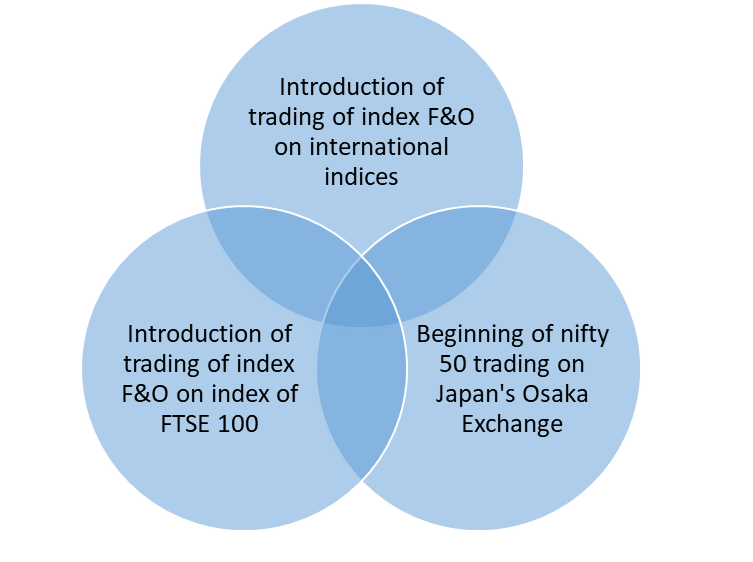

Major milestones of Nifty

Nifty has achieved some significant milestones, as follows:

Year 1996-2000:

Year 2001-2010:

Year 2010-2020:

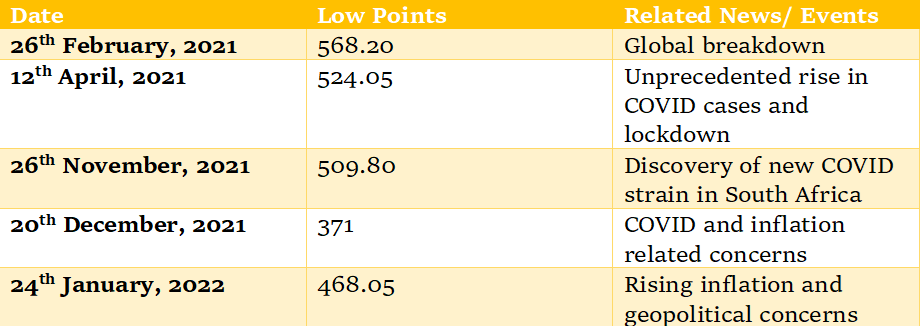

Notable lows in the history of nifty

Here is the list of the notable lows in the history of nifty.

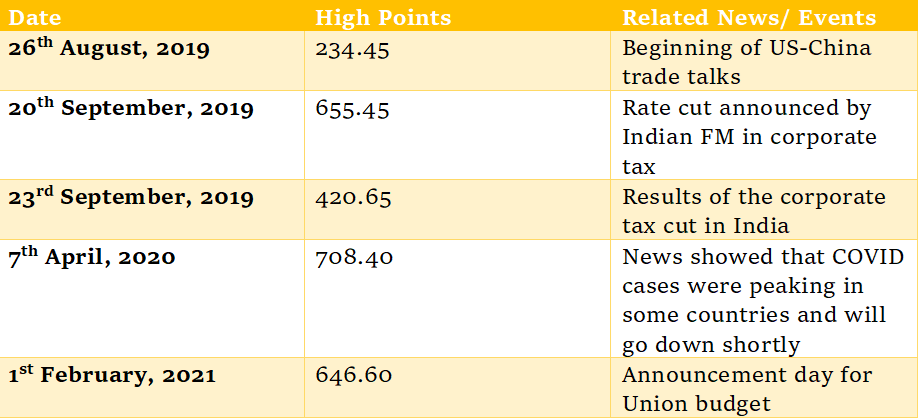

Notable highs in the history of nifty

Here is the list of notable highs in the history of nifty.

Factors that cause changes in Nifty

The main factors that cause changes in nifty are as follows:

Conclusion

The Nifty index measures the overall market performance based on the movement and weighted market capitalization of its constituent stocks.

Frequently Asked Questions (FAQs):

Q1) What is nifty?

Nifty is a stock market index that represents the performance of the top 50 companies.

Q2) Who operates Nifty in India?

Nifty is managed by India Index Services and Products Limited (IISL).

Q3) What is the full form of Sensex?

The full form of Sensex is the Stock Exchange Sensitive Index.

Q4: Who is the father of Nifty?

Ashish Chauhan is the father of Nifty.

Q5) What is the full form of an IPO?

The full form of an IPO is an initial public offer.

About Us:

Nifty Trading Academy is our academy where we teach you about the stock market and stock market indices, along with technical analysis. We also provide live market training at our academy. We also upload blogs related to the stock market as well as its basics. Keep reading our blogs.