- The futures contract is a contract.

- It is a legally binding agreement.

- It is to buy or sell a certain asset, commodity, or security at a defined price at a future date.

What is futures trading?

- Futures are the financial derivatives that generally bring together the parties to trade an item at a fixed price and date in the future.

- No matter what the prevailing market rates are at the expiration date, the buyer or seller will purchase or sell the underlying asset at a predetermined price.

- These contracts will specify the quantity of the asset and are standardized to make futures trading easier.

- Futures trading can be useful for trading speculation or hedging.

How do I start future trading?

- Trading in futures is a very simple process.

- You will only have to open a trading account with a brokerage firm that will specialize in the markets you wish to trade in.

A futures broker will ask you about the following questions:

- These questions are asked to find out how much risk the broker would let you take in terms of margin and positions.

- Here, there is no industry for commission and fee structures.

- Each broker will provide you with a different set of services and will offer extensive research and counsel.

- You can also open a paper trading account and practice paper trading before you invest your real money.

- This is considered to be a fantastic tool to double-check your knowledge of the futures market as well as how the markets work, leverage, and commissions affect your portfolio.

Types of Futures Markets

- There is a vast range of financial and commodity-based futures that are available in the market to trade.

- They will range from indices, currencies, and debt to energy and metals, as well as farm-related products.

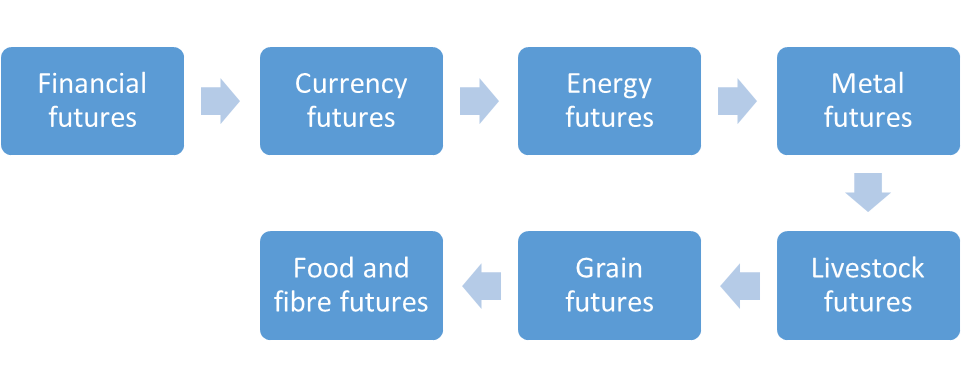

The following are the main examples of the futures contract:

Financial futures:

- This includes index contracts as well as interest-rate debt contracts.

- Index contracts will provide exposure to certain market values, whereas interest rate contracts will provide exposure to a specific debt instrument's interest rate.

Currency futures:

- Currency contracts will allow you to bet on the exchange rate of a real or virtual currency.

Energy futures:

- Energy futures will give investors access to the price of a common energy item used by businesses for manufacturing, production, or transportation.

- It is also used by governments and individuals for personal consumption.

Metal futures:

- Metals will provide you with a chance to bet on the price of particular metals that will be useful in manufacturing and construction by a lot of companies.

- The main examples of metals are gold, silver, steel, etc.

Livestock futures:

- These contracts will provide you with the chance to bet on the price of live animals that are used in the production, processing, and distribution of meat.

Grain futures:

- Raw grain material used for feeding animals and commercial processing into other products, as well as processed soybeans, are covered here under grain contracts.

Food and fibre futures:

- These contracts tend to provide exposure to the prices of specific agricultural products that are cultivated rather than extracted or mined, as well as the prices of dairy products.

Difference between futures and options:

- Options and futures are the types of financial instruments that investors will use to make money or hedge their present investments.

The main difference between the two is as follows:

| Options | Futures |

| The value of an underlying security is used to calculate the value of an option. Options will give the investor an option to purchase or sell an asset at a certain price while the contract is still in existence. | Future contract is an agreement to purchase or sell an item at a certain price at a later date. |

| Options are the type of investment that are based on derivatives. | Future contracts are the type of hedge investment that is best understood when compared with commodities like corn or oil. |

Conclusion

Future contracts are an excellent source to hedge against future price increases in an asset.

Frequently Asked Questions (FAQs):

Q1) What is future option trading?

These are the two derivative securities that will allow traders to buy or sell an underlying asset at a defined price.

Q2) How can I buy futures?

There are various exchanges that trade futures, and you can buy from them directly.

Q3) What style of trading is considered to be the safest?

Options trading is considered to be the safest type of investment.

Q4) How does the future work in the stock market?

A future contract will allow an investor to speculate on the direction of a security, commodity, or financial instrument, either long or short, using leverage.

Q5) Can I sell futures first without buying?

Yes, a trader can sell futures without buying them first.

About Us:

Nifty Trading Academy is our institute, where we teach about the stock market and trading. We also provide market trading lessons and teach proper technical analysis. We also upload blogs for the same.