Gann Theory – Stock trading is not everyone’s cup of tea. It requires the right set of knowledge and skills. In fact, indulging in intraday trading without good knowledge is like fighting in the battlefield without arms and ammunition. Therefore, it is not wrong to say that traders need to be more careful and try to take the right position to earn more in the stock market.

One such way to make good gains with trading is learning the Gann trading strategies. An American trader and market theorist, William Delbert Gann, developed Gann trading theory in 1935. The theories given by him are popular and reliable among the trader. In fact, most of the traders take their position by looking at the price and relying on the Gann angles. In this article, we shall learn the basics of Gann theory and much more.

What is Gann Theory?

Gann theory predicts the movement of stocks after taking into account the past, present, and future of the markets. By analyzing and assessing the information of the different periods including the short-term market highs and long-term market highs, angles are drawn to determine the future market trend. Gann was a believer that mathematical relationships and geometrical angles can predict future price movements.

The whole theory of Gann is on the basis of angles. In this segment of the story, we shall study the Gann angles.

What are Gann Angles?

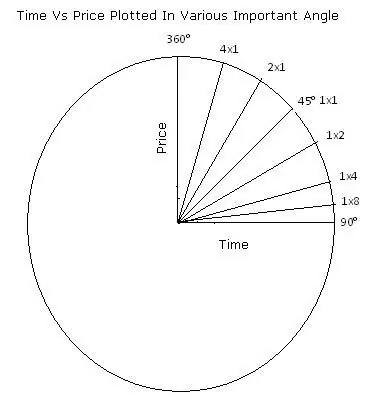

The Gann theory predicts the price movements with the help of a series of angles. The angles are drawn at different price points. The Gann angles represent the past, present, and future characteristics of a stock price. In fact, the calculation of Gann angles is done after connecting the price points on the charts.

Now let us see the basic idea behind Gann theory.

Basics of Gann Theory

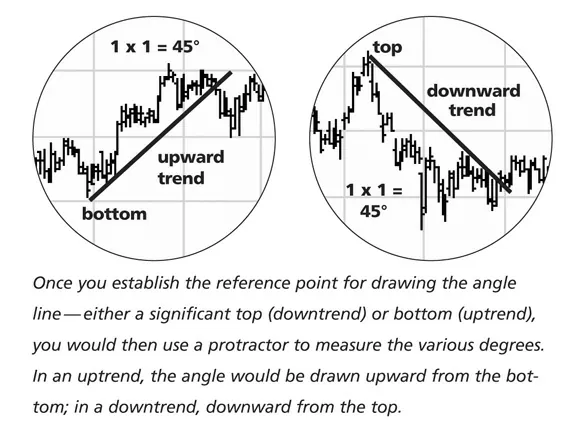

To understand the basics of Gann theory let us take an illustration. Suppose the market is in an uptrend and it stays above the ascending angle without breaking it. In such a case, it suggests that the market shall continue to remain in the uptrend in the coming period. Similarly, if during the downward trend the price remains below the descending triangle, it suggests the market shall continue to weaken.

The traders use Gann trading strategies to make good returns in the market. There are Gann theory books available in the market through which traders can learn. However, to simplify things for you, the below points suggests the application of Gann's theory. This will give you an idea of the Gann theory and its concepts.

Application of Gann Theory

To understand the Gann theory calculations one needs to study the behavior of the following three things in the market.

- Time Study: The time study model suggests the time when the stock price shall reverse. In addition, time study reads the historical data that helps in deriving the future fate of the markets.

- Price Study: The Gann angle lets us see the angles suggesting the price patterns of the stock. The prediction of price movement in the stock relies on the pivot levels, support, and resistance points.

- Pattern Study: The activity of the investors and movement of a particular stock is kept in check with the pattern study. The pattern study in Gann theory studies the trends and patterns that indicate the reversal in the stock.

About Nifty Academy

NTA® is a leader in providing stock market education to investors. In fact, with our classes, the investor can learn to read and understand the Gann theory for intraday trading. Furthermore, the investors can become successful intraday traders by learning from us. We provide beginners and old investors with regular education material. In addition, by learning from us, the investors will not only understand reading the charts but also gain other information and knowledge about the stock market. Just reach us via email or call, for any further information or queries.

Don't Forget to Read:

- Top 10 Stocks Exchanges in the World

- Top 5 Blue-chip Companies

- Importance of Stock Market Training Course

- How to create your Stock Portfolio?

- How to Earn 5000 Per Day in Intraday Trading?