MCX: Multi Commodity Exchange of India Ltd

MCX is India’s largest and Independent commodity derivative exchange where the clearance and settlement of commodities take place. It was established in 2003 and is based in Mumbai.

It offers options trading gold and futures trading in non –ferrous metals, bullion, energy, and a number of agricultural commodities (mentha oil, cardamom, crude palm oil, cotton and others)

Index Series of MCX are:

- iCOMDEX

- iCOMDEX Composite

- iCOMDEX Base Metals

- iCOMDEX Bullion

- iCOMDEX Gold

- iCOMDEXCopper

- iCOMDEX Crude oil

Multi Commodity Exchange of INDIA provides live feeds for all traded commodities and are easily available on different websites like Money Control, Economic times, MCX India.info.

List of the commodities that are traded in the MCX

- Metal – Aluminium, Aluminium Mini, Copper, Copper Mini, Lead, Lead Mini, Nickel Mini, Zinc, Zinc Mini, Brass (futures)

- Bullion – Gold, Gold Mini, Gold Guinea, Gold Petal, Gold Petal (New Delhi), Gold Global, Silver, Silver Mini, Silver Micro, Silver 1000.

- Agro Commodities – Cardamom, Cotton, Crude Oil, Kapas, Mentha Oil, Castor seed, RBD Palmonlien, Black Paper.

- Energy – Brent Crude Oil, Crude Oil, Crude Oil Mini, Natural Gas.

How MCX works?

The commodities market works the same as the stock market. It is a physical or a virtual platform, where traders can buy, sell or trade various commodities at current or future dates.

Traders can also do trading using futures contracts. It is an agreement between the sellers and buyers where the buyers promise to pay the agreed amount at the date of transaction where the seller delivers the commodity at a pre-decided date in the future.

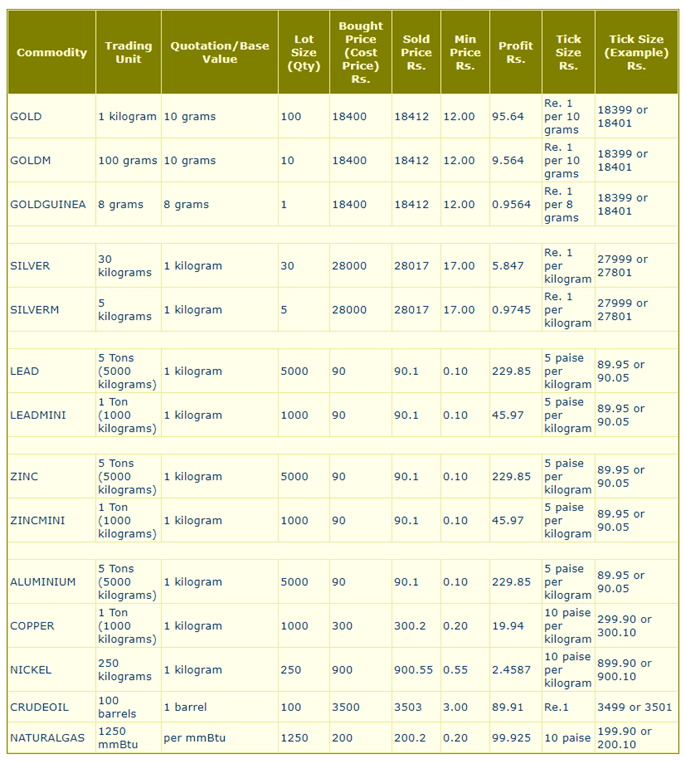

MCX: Lot Size and Tick Size

In commodity trading, Tick Size (Tick Movement, Tick Data) is the smallest amount. A price changes as the trend is up or down. The following table will help you to know about the minimum amount a price has to increase or decrease from the cost price so that you can get an idea about profit/loss.

How to trade in MCX market?

There are two ways of trading in the MCX market.

Online Trading: With this platform, you can do trade from your mobile application or from the software provided by the broker.

The main advantage of trading online helps you to place an order at the right time and you can see all the history and transactions of your orders whenever you want to see them.

If you have a high-speed internet connection then you can go with this option.

Offline Trading: This is another way to trade in the MCX market. You can contact your broker to place the order. You can trade from anywhere with just one phone call and a trade dealer (Broker) place your order and also, they can help you to make the right decisions.

Some Basic General Key Points to Starting commodity trading in India.

Commodities Trading: It is similar to stock trading. Instead of buying and selling shares of companies, here traders/ Investors buy and sell the commodity product.

Better Strategies to start with commodity trading:

Limited/Minimum Investment Amount- To start trading in the commodity market minimum amount is? 6000/- required. If you want to trade on Mini Zinc, do you need it? 5,500/-

Transferring money to trade: You can directly deposit online with net banking, or offline with cheque, Demand draft whichever is suitable.

Fundamental needs for trading: For Online trading, fast broadband internet connection and trading application is a basic need. Ask your broker for the application if you don’t get it from your broker.

Market Trading Time: Multi Commodity Exchange will open at 10 AM and will close at 11:30 PM.

Trading Strategies: To earn from the commodity market you required proven trading strategies that help you to make successful trades. Also, discipline and emotion are very important for trading.

MCX India Website: http://www.mcxindia.com

NTA® is India’s best share market institute that helps you to become a professional trader. Here, you will learn our different unique setups and copy-righted methods that give you best results.