- Nobody will be able to thrive in a professional environment without even understanding the basics of the work that they are doing.

- It can either be a chef, an accountant, an engineer, a writer, or even a trader.

- Here, we will discuss some of the basic stock market terms that are used every day and also which will constitute the basics of being a trader.

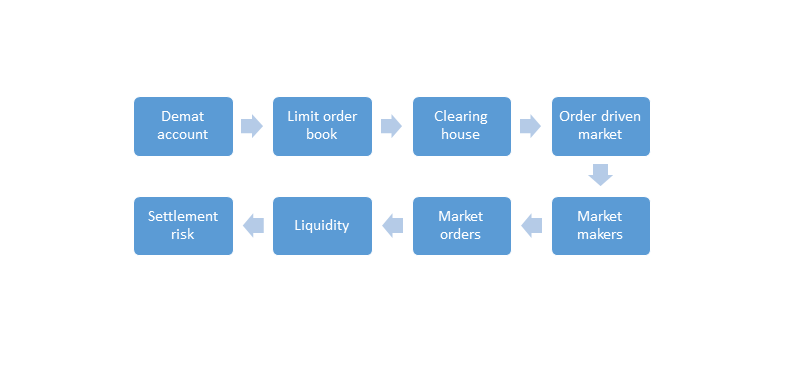

8 basic stock market terms

The stock market uses a variety of terms.

Some of the basic terms are as follows:

Demat account

- A demat is a short form for dematerialized account.

- It is very much necessary for trading.

- In stock market terms, this will mean that all the shares, mutual funds, bonds, etc., will be credited and debited through this account.

- A demat account can be opened by anyone through various online platforms such as Zerodha, Upstox, and Delta Exchange.

- Certain banks will also allow their customers to open a demat account.

Limit order book

- A limit order is of two types, such as a buy limit order and a sell limit order.

- A trader will buy or sell a share at a preset price or higher, which can be the case of a sell limit order, and lower, which is the case of a buy limit order.

- In stock market terms, a limit order book is a record of the outstanding limit orders, which can be kept executed by the security specialist as and when the specified price is met by the market.

Clearing house

- The term clearing house in the stock market will refer to an organization that will act as a middleman between the traders.

- After the transaction has been completed, the clearing house will initiate the finalization of the trade and will ensure that both parties have been honest towards their contractual obligations.

- Apart from this, the clearing house will also collect the margin payments and oversee the delivery of the assets.

Order-driven markets

- In the stock market, the order-driven market is the one where both the buyers and the sellers will showcase their preferred buying and selling prices.

- Along with this, they will also specify the number of shares that they wish to deal with.

- It will also cater mainly to the market as well as the limit orders.

- However, there is also a considerable lack of liquidity providers or market makers, and hence there is liquidity.

Market makers

- Market makers are either individuals or organizations that will act as consultants to the investors and will also provide tracking services as well as maintain the constant flow of the market by trading themselves.

- In stock market terms, this will essentially mean that the market makers will maintain the liquidity of the market by continuously buying and selling the securities that they will keep on behalf of their clients as and when they are ordered to do so.

Market order

- A market order is an order that an investor or trader will give to their broker or the market maker to buy and sell the shares at the best possible price available in the market.

- In the terms of the stock market, a market order is a price that is set by the market and not the traders.

Liquidity

- In the stock market, liquidity will refer to those assets that will not lose their value after being converted into cash.

- Assets such as gold, gems, property, etc. can also be considered liquid.

- But their value as liquid is always less than the cash.

Settlement risk

- Settlement risk is not common in trading.

- It is a scenario in which the traders should be prepared to face.

- In stock market terms, it is the possibility of one or both parties failing to deliver on their end of the transaction.

- Settlement risk is of two types, which are default risk and settlement timing risk.

- Default risk is when a trader will fail to deliver entirely on the contract even after the party has.

- Settlement timing risk is less severe as the trade will still take place, although later than the agreed-upon time period.

Conclusion

The above were some of the most commonly used terms that are used in the stock market.

Frequently Asked Questions (FAQs)

Q1) What are the key terms in the stock market?

The main terms in the stock market are the bear market, bull market, dividend, ask, bid, and blue-chip stocks.

Q2) What is the N0.1 rule in trading?

Always use a trading plan is the N0.1 rule in trading.

Q3) What is a blue chip share?

It is a stock that is issued by a large, well-established, and financially sound company, and that too with an excellent reputation.

Q4) Who owns NSE?

NSE is under the ownership of various financial institutions, such as banks and insurance companies.

Q5) Who owns BSE?

BSE is owned by Shri Sundararaman Ramamurthy.

About Us

Nifty Trading Academy is our academy where we teach you about the stock market as well as technical analysis. We also provide live market support and upload blogs for the same.