- Mastering the position of a stock trader and learning how to trade stocks can be an exciting as well as challenging experience.

- As a new trader or investor, you will experience highs and lows along the way, and there will also be periods of success and loss.

The Basics of how to trade stocks

- To enter the stock market, you will need to understand the market.

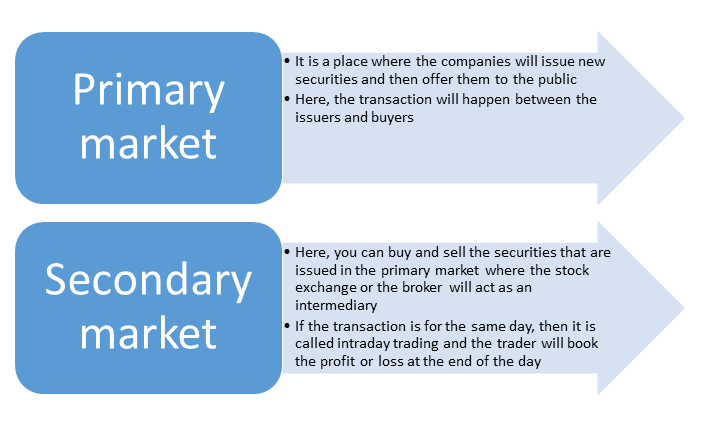

- There are two different types of markets.

They are as follows:

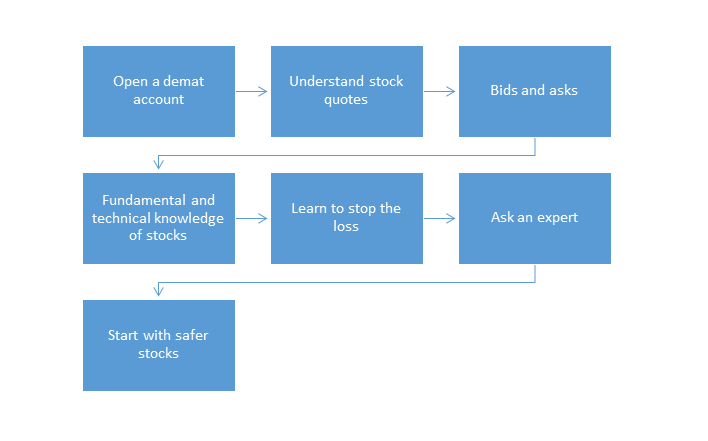

The process of stock trading for beginners:

When a beginner wants to enter the world of the stock market, they will have to follow the process.

The process is as follows:

Open a Demat account

- You will need to open a demat account or a brokerage account if you wish to enter the share market as a trader or an investor.

- Without a demat account, you cannot trade in the stock market.

- A demat account is similar to a bank account, where you hold money for trading.

- You will electronically maintain the securities you purchase from the stock market in the demat account.

Understand stock quotes

- Stock prices will move as per demand and supply, economic factors, and fundamental factors such as company profitability and trader sentiment.

- With the help of gaining knowledge of such aspects, you will be able to enhance your understanding of stocks and stock markets.

- This will help you determine the right entry and exit points.

Bids and asks

- A bid price is the price that is the maximum price.

- It is the price that you are willing to pay to buy a stock.

- The ask price is simply the opposite of the same.

- It will represent the minimum price at which the seller will be willing to sell the stocks.

- To ensure a profitable trade, it is very important to decide on the correct bid and ask price.

Fundamental and technical knowledge of stocks

- You should study the fundamental and technical analysis of the stocks so as to plan your trading.

- Fundamental analysis will evaluate security by measuring its intrinsic value.

It will also consider various dynamics, such as the following:

Whereas, technical analysis will be evaluating the stocks based on their past price and volume chart to predict their future potential.

Learn to stop the loss

- Volatility can be considered an implicit characteristic of the stock market.

- Due to this, the beginner should understand how to prevent a heavy loss.

- When you are planning to execute any trade, you must set a stop-loss price to minimize the loss.

- If you fail to stop the loss, then you might end up heavily affecting your capital.

Ask an expert

- The share market is always unpredictable.

- Nobody will be able to predict the exact stock price.

- However, it is better to take the advice of the experts who will be helping beginners make the right trading decisions.

- It will also guide you to make the right choice.

Start with safer stocks

- A big loss in the very beginning will be bringing your confidence down.

- So, the best choice is to start with very volatile stocks.

- This will be a slow start, but it will give you the ability to sustain a good performance even in adverse market conditions.

Conclusion

Investing in the stock market is a lucrative opportunity for investors who are looking for a long-term outlook as well as a diversified portfolio.

Frequently Asked Questions (FAQs)

Q1) Is it possible to invest Rs. 50 in the stock market?

Yes, it is possible.

Q2) To invest in the stock market, can you purchase the stocks without a broker?

Yes, you can do so by investing in shares through the direct stock purchase plan of the company.

Q3) Is it safe to trade online?

Yes, it is safe to trade online.

Q4) Are stocks a good investment for beginners?

Stocks are a good investment for beginners if they will leave their money invested for at least a period of five years.

Q5) Should you be experienced enough to start trading online?

No, you won’t need any experience to start trading online.

About Us

Nifty Trading Academy is our academy, where we teach you about the stock market as well as technical analysis. We also provide live market trading as well as training and upload blogs for the same.