- GST stands for goods and services tax.

- It has been a game-changer for the Indian economy.

What is GST?

- Goods and services tax is popularly known as GST.

- It is one of the major tax reforms in the country over the last few decades.

- It has subsumed most of the indirect taxes that are imposed by the central and state governments, such as VAT, service tax, and excise duty.

- GST is based on the ideology of “one nation, one tax.

- It can be considered a multi-stage and destination-specific tax system.

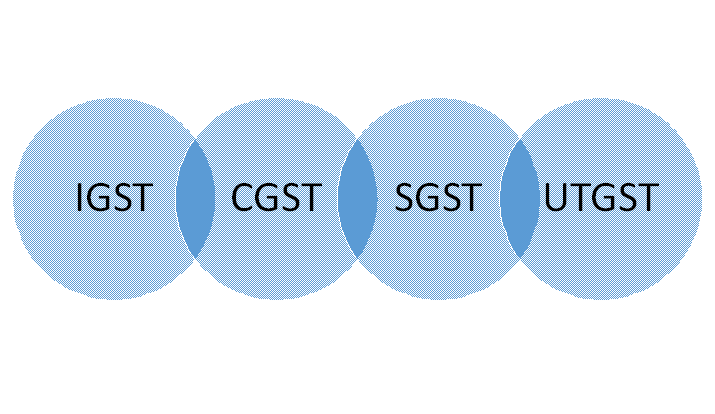

- GST is also further categorized depending on where the goods are produced and at which place they are sold.

They are categorized as follows:

Integrated Goods and Service Tax (IGST)

- It is applied to imports, exports, and cross-border transactions and is collected by the central government.

Central Goods and Service Tax (CGST)

- Levied on intrastate transactions, it is collected by the central government.

State Goods and Service Tax (SGST)

- It applies to the intrastate exchange of goods and services, and the state is responsible for collecting the same.

Union Territory Goods and Service Tax (UTGST)

- Taxes are applicable to transactions within the Union territories.

Benefits of GST

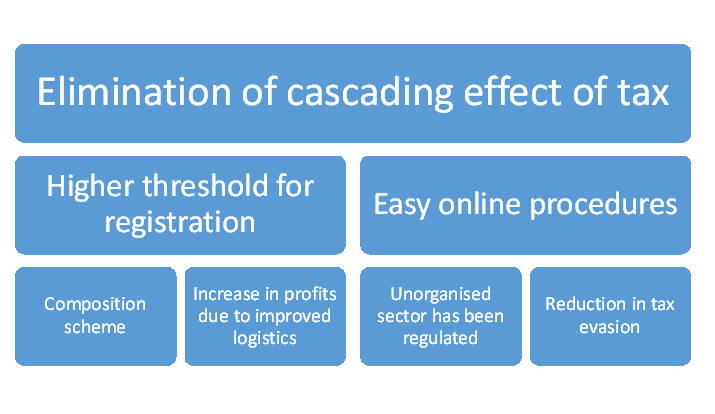

GST has come with several benefits.

They are as follows:

Elimination of the cascading effect of tax:

- Earlier, the tax liability at each production level used to include tax collected at the previous stage.

- This would in turn inflate the cost of the product, and the consumer should also bear the burden of multiple indirect taxes.

- This can also be described as a tax-on-tax concept.

- One of the best advantages of GST is its simplified and integrated taxation system.

- It will use input tax credit system to remove the cascading effect of tax.

Higher threshold for registration

- Earlier, any business with a turnover of Rs. 5 lakh or more had to pay VAT.

- The threshold for service tax was Rs. 10 lakh.

- Under the GST scheme, the threshold is fixed at Rs 20 lakh.

- This benefit has brought a great advantage to many small traders and service providers.

Easy online procedures

- The process of GST from start to finish, i.e., from registration to filing, has been made online and is very simple.

- This is saving the cost and time of the traders and leading to fewer complications as well.

Composition scheme

- This is very beneficial for small businesses that have a turnover of Rs. 20 lakh to Rs. 75 lakh.

- It is also giving them the option to lower the taxes by paying the GST at a fixed turnover rate, thereby avoiding GST formalities.

Increase in profits due to improved logistics

- In order to reduce state-entry taxes as well as other interstate formalities, businesses had to maintain multiple warehouses across the states.

- These warehouses were forced to operate even at levels that were beyond their capacity.

- This increased the production cost.

- With the advancement of GST, businesses have shown interest in operating warehouses at their strategic locations only, which has helped them cut their logistics costs.

The unorganized sector has been regulated

- There were certain industries, such as construction and textiles, that were unorganized.

- GST brought accountability and regulations to these industries.

- This is because input credit can be availed of when the supplier has accepted the amount.

Reduction in tax evasion

- The rigors of GST have made it difficult to evade the tax.

- This is an advantage to the government from such a unified scheme of taxes.

Drawbacks of GST

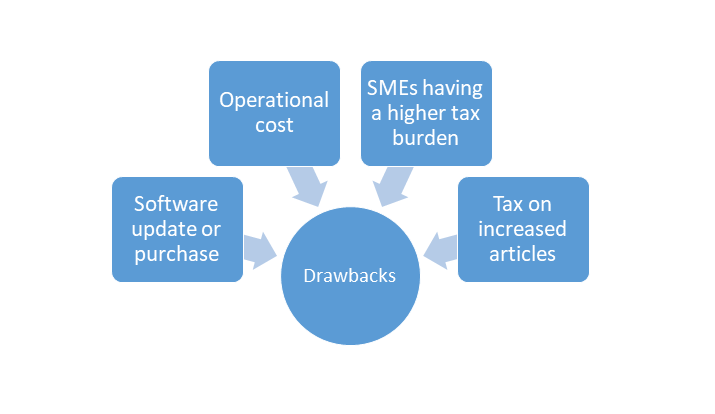

With the above benefits, GST has also got some drawbacks

The main drawbacks are as follows

Software update or purchase

- Many enterprises will have to invest their capital in either updating their existing software to make it GST-friendly or purchasing a new one.

Operational cost

- The firms will need to adhere to the GST norms, which implies that they should be billing their products as per the GST requirements.

- This implies that the company has to incur costs to get a GSTIN, file timely returns, employ a tax professional who will know about the GST or might have to equip its own employees with the knowledge, and also maintain digital record-keeping.

SMEs having a higher tax burden

- SMEs can opt for the composition scheme and pay only 1% tax on turnover, then abide by less compliance.

- But with this, they will not be able to claim input tax credit.

Tax on increased articles

- To avoid the inverted duty structure, many articles that were earlier exempt from taxes had to be brought under the GST regime.

Conclusion

The government has tried to establish a more open and transparent tax system in our country with the introduction of GST.

Frequently Asked Questions (FAQs)

Q1) What is the full form of GST?

The full form of GST is Goods and Service Tax.

Q2) What does GST mean?

GST is a value-added tax levied on most goods and services sold for domestic consumption.

Q3) Why is GST important?

GST is important because it has increased supply chain efficiency by lowering the time and cost to ship and transfer goods across state boundaries.

Q4) Who is the father of GST in India?

GST was introduced by Atal Bihari Vajpayee.

Q5) Who controls GST in India?

The GST Council will control GST in India.

About Us

Nifty Trading Academy is our academy, where we teach you about the stock market as well as technical analysis. We also provide live market trading as well as training and upload blogs for the same. We also regularly revise our blogs with the announcement of new reforms.