Intraday trading techniques are essential for day traders. Fluctuations in the stock market teach many traders so many things. With the help of proper day trading tricks and knowledge, traders can improve their trading style and generate a handsome amount of profit.

Intraday Trading Strategies

GAP Strategy

Before we directly jump to intraday trading strategies, you need to understand the gaps. First of all, let’s have look at the GAPS.

GAPS

The gap occurs when futures prices suddenly drop lower, with the high price for the day being below the previous day’s low or with prices moving higher with the day’s low exceeding the previous day’s high.

Trading history indicates there’s a high probability that gaps will eventually be filled. A gap is filled if prices later trade in the range at which the gap occurred. Since gaps are usually (not always) filled, they become price objectives for the chartist. Gap typically occur when major new market information becomes available, such as a change in the medium-range weather forecast.

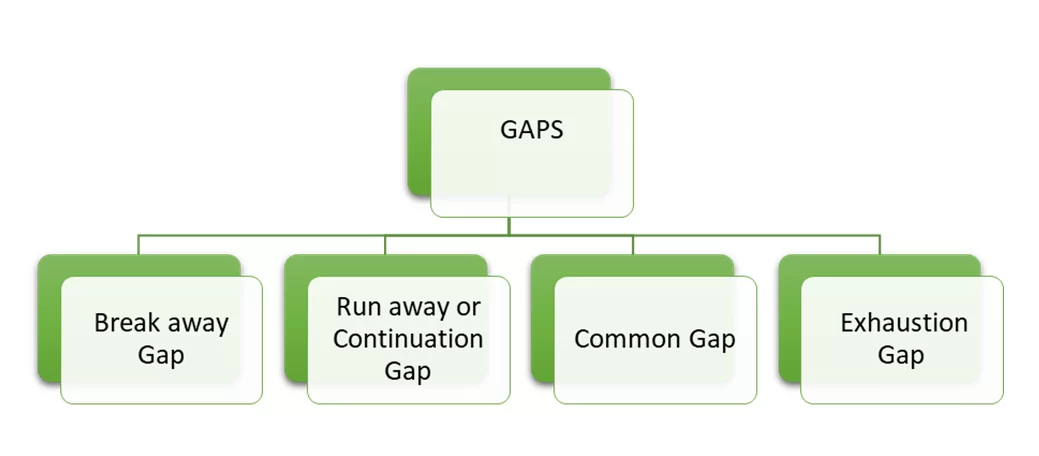

Types of Gaps

Gaps can be classified into Four Types.

Intraday Trading Strategy with GAPs

Trading with Gaps

Gaps in trading are a common phenomenon and very commonly occur in stocks. A Gap is nothing but an empty space between the closing price of the previous candle and the opening price of the next candle.

With analysis of different types of gaps and nature, Intraday traders can get an idea about the further movement of stock price.

Break Away Gap

- A Breakaway gap is typically formed at the start of an uptrend or when the price is just coming out of a consolidation phase.

- It is called as a Breakaway Gap because price tends to break out from its previous consolidation to establish a new market move.

- The image below shows an example of a breakaway gap.

- It Signals a change in market psychology about the future prospect of security, especially when accompanied by above-average volume.

- A Bullish Breakaway gap forms when a security gap up after an extended decline, extended based on consolidation period.

- A bearish breakaway gap forms when a security gap down after an extended advance.

Runaway or Continuation Gap

- This type of gap is formed within the prevailing trend is usually said to occur midway of a trend.

- When a runaway gap is identified, traders know that the previous trend will continue and trade in the direction of the trend.

- Trading while the continuation or runway gap occurs, is most probably one of the safest methods to trade.

- An upside runway gap will often occur in a momentum stock. This causes the stock to open significantly higher than where it closed the previous day.

- A downside runway gap will often occur in a stock which moving swiftly lower.

- Runway gaps are not filled very quickly, as prices are skipping to the next trading levels.

Common Gap

- This type of Gap is one of the important gaps and is formed. Common gaps can be formed at any time of the trading session.

- Common Gaps are more likely to be filled within a few price bars/candles and therefore be used for very short intra-day trading.

Exhaustion Gap

- These Gaps are formed towards the end of the previous trend and indicate the last final push in momentum before price start to fizzle out.

- Exhaustion gaps are found with the stocks as it is commonly identified with a gap being formed with an unusual surge in volume.

- It occurs within the direction of the previous trend.

- This type of GAP occurs let in a big price move and is often a warning that the strong trend may soon come to an end.

- The example above shows an exhaustion gap to the upside which occurred in the stock. And the gap was quickly filled. These emotional price gaps caused by panic can provide some excellent trading opportunities when looking for a reversal.

Intraday Trading Techniques

Here are some smart intraday tricks to help you trade in the stock market;

- Avoid carrying positions overnight

- You must 1st target when the scrip price is about the 1st target, risky traders square and safe traders square is off 50% of the position

- The square off may remain 50% when the scrip price is about 2nd target and if the scrip price is not near the 2nd target through the entire day, then you must square off at the closing

- You must exit when scrip price break, stop loss level, regardless of the quantity is available to you. In this situation, you must never wait further and adhere to stop-loss immediately

- You can choose to trade all instead of choose one or two scrip

- You can make use of Stop Loss available with Buy & Hold, BTST, and Positional options

Common Investment and Intraday Trading Tricks

Besides the above said trading tricks, here are a few more common trade and investment tricks that you can follow to achieve the best Intraday trading strategy:

- The broker will give the stop-loss level, which will specify the level above or below and the market will say if the call has gone wrong

- You must be aware that the stop-loss serves as an essential risk control mechanism, therefore it must be always readily available for the trader

- You must try to book the profit at least when prices reach targets and if you continue to hold the positions, then you must use trailing stops for locking in your expected profits

- Avoid chasing the stock, particularly when you are unable to buy the stock, as it may hit the circuit levels on successive days and thus do not buy them

- Everyone is aware of the fact that trading involves considerable risks it. Every trader must trade at his own risk and comfort. Moreover, you must also be aware that the analyst will not be responsible in any terms for your loss

Must Read – Intraday Trading Rules

Investment & Day Trading Formula

- You can consider your investment whenever the market is high and expected to fall soon

- When the market is low and if there is not external factors disturbing, then it will rise, therefore you can consider this marketing condition

- The best time to invest is when the market is down, however you must remember the fundamentals to avoid risks

- Avoid chasing a stock and buy when the market is in the grip of panic

- Try to invest only in the fundamentally strong stocks and that are undervalued

- Try to avoid loss-making companies and look for the dividend-paying record

- Try to invest a fixed amount every month on the stock

- Try to buy when everyone is selling and sell when other traders buy

For intraday trading, the best formula would be while punching the trades for the intraday make sure that you have done enough research and analysis on the particular stock with steps that you need to follow with discipline.

For improving your intraday trading, the best formula for intraday trading would be discipline, and other than the pointers that are mentioned below need to be followed with discipline:

- Do proper analysis and research while selecting the stocks

- Get complete information about the market trends

- Work with Risk Management in intraday trading

- Stay updated with the news about the market’s

- Don’t let emotions to play while intraday trading

- Avoid greed and fear factor

- Don’t do overtrading in intraday trading

- Use the basic technical indicators

- Avoid Penny Stocks

- Start with small capital

These were some of the pointers for intraday trading that would be best for the traders if they follow with full discipline. Always act or trade according to your plan or with the discipline trading. Once the target is hit then you need to book your profits immediately and don’t stay too long in the market. With the help of stop-loss, try to cut down your losses with also using the orders.

Don’t try to do trading in many stocks and try to trade in multiple sectors. Try to analyze the charts and use more the strategies that will work for you and apply the indicators in the intraday.

There are many intraday strategies you can also follow:

- GAP Strategy

- Breakout Strategy

- Early Morning Trade Strategy

- Elliot Wave Trading Strategy

- Bollinger Bands Trading Strategy

- Pullback strategy

- Golden Pullback strategy

These are the strategies you can approach to learn and implement the same in your intraday trading and you make a handsome amount of profits.

Thanks for your reading!

Related Article: Day Trading Tips for Beginners