- The union budget for 2024 came on July 23rd.

- The finance minister, Nirmala Sitharaman, presented the union budget for 2024–25 in parliament and also announced the modifications to the direct taxes.

- But the union budget was quite a bit harsh for the stock market.

Budget and stock market

- Sensex and Nifty survived the shock of the June 4, 2024, election.

- But they became uncomfortable with the main event, the Union Budget.

- When the finance minister dropped the bombshell of tax, sensex fell by up to 1278 points, only to focus back on the push for both growth and fiscal responsibility.

- From the perspective of the market, raising STCG to 20% and LTCG to 12.5% is a major blow to the body.

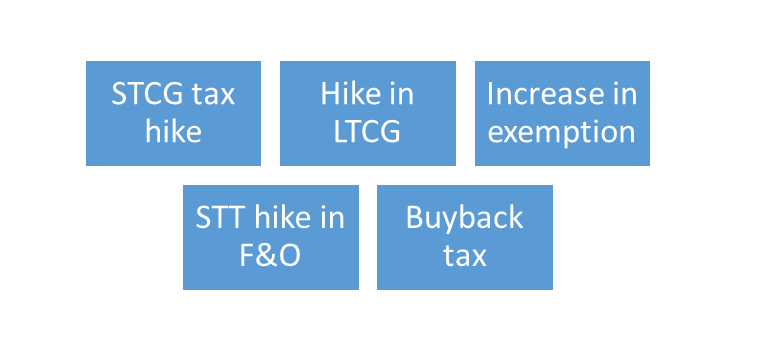

Key Takeaways for stock market investors in Budget 2024.

There are many takeaways for stock market investors when it comes to the budget for 2024.

They are as follows

STCG tax hike

- In the recent budget, Finance Minister Sitharaman increased the short-term capital gains on certain financial assets to 20% from 15% at present.

- This has impacted several day traders.

Hike in LTCG

- The long-term capital gain (LTCG) on all the financial and non-financial assets has also increased from 12.5% to 10%.

- This certain increase is considered to be the hurdle rate for investors in financial assets, and hence there is a negative sentiment.

- Markets have gone up in the run-up to the event over the last few months, and hence this will result in a cooling in the financial markets.

- This will be done before the focus moves back to corporate earnings and the strength of the Indian economy.

Increase in exemption

- This year budget has proposed to increase the limit of exemption of capital gains on financial assets to Rs. 1.25 lakh per year from Rs. 1 lakh per year.

STT hike on F&O

- The finance minister has raised the STT in the F&O segment in the budget so as to discourage retail traders from punting household savings into derivatives trading, which is also termed gambling.

- It is proposed to increase the rate of STT on the sale of an option in securities from 0.0625% to 0.1% of the option premium.

- There is also an increase in the rates of STT on the sale of futures in securities, from 0.0125% to 0.02% of the price at which such futures are traded.

- These changes will come into effect on October 1, 2024.

- This is the day when the exchange turnover charges will be reduced.

- The net impact of this change will largely affect the net neutral for the traders.

Buyback tax

- The budget has also proposed to tax income received on the buyback of shares in the hands of the recipient.

- The proposal to tax the buyback of shares by domestic companies in the hands of shareholders will bring parity between the tax implications of declaring dividends and buybacks.

- As per history, shareholders have enjoyed the benefits of lower tax implications on the buyback, with savings of approximately 12% on the distribution of profits by the companies in the form of buyback vs. dividend.

- This benefit will no longer be available to shareholders.

- Also, the cost of acquisition of the shares bought back shall be allowed as a capital loss to the shareholder against any other capital gain income.

Conclusion

Budget got a big no when it came to the share market segment, as this has affected day traders to a huge extent.

Frequently Asked Questions (FAQs)

Q1) What happened to the stock market during the budget?

The stock market on Tuesday, July 23, 2024, declined significantly as the government proposed to raise the tax on capital gains and also on trading derivatives.

Q2) Why is the market falling after the budget?

The main reasons for the fall in the market are a disappointing budget, below-par Q1 results, weak global cues, a fall in the purchasing power capacity of premium buyers, and the trend reversal by the anchor market.

Q3) Which stock will go up after budget?

SBI Card and Oberoi Realty will go up after the budget.

Q4) Which share is the best for the next 5 years?

Reliance Industries is the best for the next 5 years.

Q5) What is a budget in trading?

It is an important tool for managing finances, allocating resources effectively, and achieving financial goals.

About Us

Nifty Trading Academy is our academy, where we teach you about the stock market as well as technical analysis. We also provide a live trade facility and upload blogs for the same.