Angel Broking Brokerage Charges – Angel Broking is one of the most popular stock broking firms in India. They have been a great wealth generator for people who are trading and investing in the stock market. Angel Broking has more than 900 branches and 8500 franchises across India. The wide network provides them access to most of the Indian market and makes them a dominant player in the stock market broking firm.

The experts at Angel Broking regularly analyze and give their opinion on various stocks to help the traders. They provide trading through various platforms like smartphones, tablets and desktops. Angel Broking is a member of both the major stock exchanges in India; Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Angel Broking is also registered with the biggest commodity exchanges of the country; NCDEX and MCX.

Let us now see the Angel Broking charges.

Angel Broking Charges

The charges while opening a Demat or trading account are as follows

- Stock trading account – Nil

- Demat account – Nil

- Annual Maintenance Charge- As per Account type

- Commodity trading – Nil

Angel Broking provides multiple services to the account holders. Therefore, it has categorized its account into various categories.

#1 Angel Classic

This account is for beginners in the stock market. The minimum amount for opening an account is Rs. 10,000. This amount will later be a part of trading.

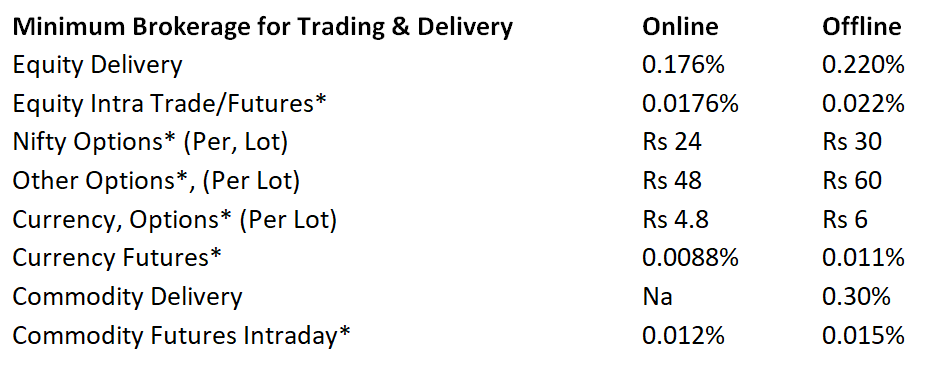

#2 Angel Preferred

In this type of account, there are no annual maintenance charges. You have to pay a minimum amount of Rs. 25,000 to get a low brokerage of .224% delivery and .0224% intraday &Future.

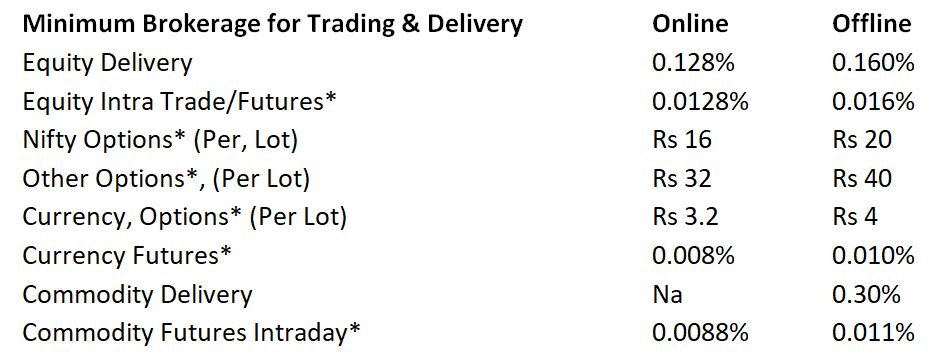

#3 Angel Premier

This is account for the customer who opens an account with Rs. 50,000 to Rs. 99,999. In Angel Premier account the customer pays lower brokerage rate of .176% delivery and .0176% intraday & future.

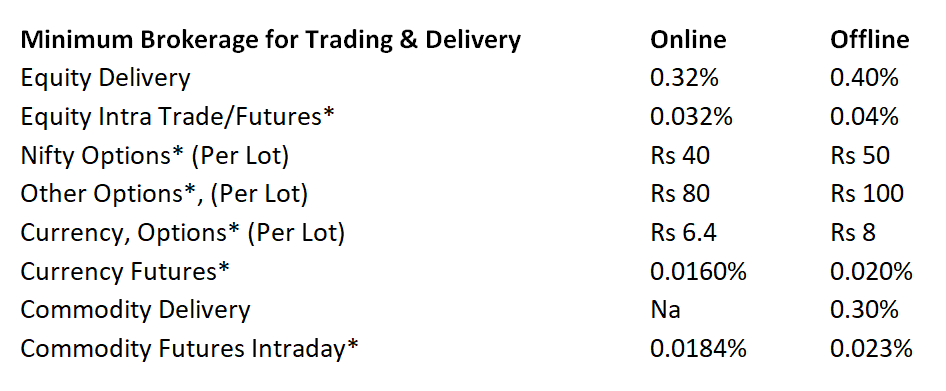

#4 Angel Elite

They holders on Angel Elite will have to pay the least amount of brokerage. These customers will have to open their account with an initial amount of at least Rs. 1 lakh and more. The brokerage charges are as follows;

Now let us have a look at the brokerage charges specifically.

Angle Broking Brokerage Calculate

The brokerage charges are dependent upon the initial margin you pay while opening an account. Higher margin you pay lower will be the brokerage rate. This is because you pay a higher margin to trade more and you are in a better position to negotiate. So let us have a look at Angel broking brokerage charges according to the initial margin paid.

Initial margin paid more than Rs. 25,000

- Intraday (Buy & Sell): Rs. 0.04% per trade

- Delivery (Buy & Sell): Rs. 0.40% per trade

- F&O (Buy & Sell) : Rs. 0.04% per trade

Initial margin paid more than Rs. 50,000

- Intraday (Buy & Sell) : Rs. 0.03% per trade

- Delivery (Buy & Sell): Rs. 0.30% per trade

- F&O (Buy & Sell): Rs. 0.03% per trade

Initial margin paid is more than Rs. 1,00,000

- Intraday (Buy & Sell) : Rs. 0.02% per trade

- Delivery (Buy & Sell) : Rs. 0.20% per trade

- F&O (Buy & Sell) : Rs. 0.02% per trade

The above are the booking charges of Angel Broking. Since Angel Broking has a wide customer base it provides them with 4 different trading platforms. They are as follows;

- Angel Broking Web

- Angel Mobile App

- Angel SpeedPro

- Angel Eye

About Us

NTA® is one of the most respected stock market education providers of the country. Our in-house experts and professionals teach the beginners to learn the reading of charts and understand the technical reading of stocks. By learning with us you can become a successful intraday trader. In addition, you can become a successful long term investor as well. All you need to do is contact us via call or e-mail and know our quotation. You can also reach us if you have any query or need further information. We will be glad to serve you.