- Most of us will wonder: What could be the strategy of the investors who have earned millions from their respective investments?

- The mere fact is that most successful investors in the world use some common-sense approaches to create huge wealth from their investments.

- Each investor has his own approach and trading style, and that investor will stay committed to it for years.

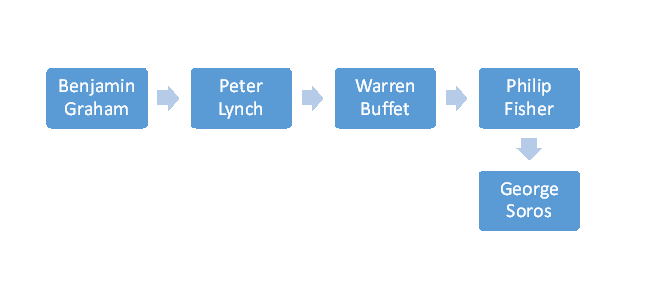

Top 5 investors in the world

There are many investors in the world.

But the top 5 investors are as follows:

Benjamin Graham

- Benjamin Graham is known as the father of value investing.

- He has also inspired many great investors, such as Warren Buffet.

- His peers and those within the investment industry call him “the father of security analysis and value investing.”

- His investment philosophy is all about a common-sense approach.

- He has his focus fixed on the principle that investments should only be made if they are worth substantially more than their cost.

- This strategy can be termed the “margin of safety.”.

- This strategy signifies the buying of the asset at a discount to its intrinsic value.

- This type of investment strategy will not only act as a shield for the investor but will also offer high-return opportunities.

- The main focus of his was on the companies that had above-average profit margins, low debts, and substantial cash flows.

- He was aware that fluctuations are a part of the market, and they can also be advantageous if they are traded well.

- He would buy the assets when they were at a bargain, example, when a strong company would not perform well, and then he would sell the holdings when they were overvalued.

- His decisions used to be based on hard facts as well as a proper evaluation of market trends.

- Due to this, his investment strategy will show that investors will need to buy low and sell high.

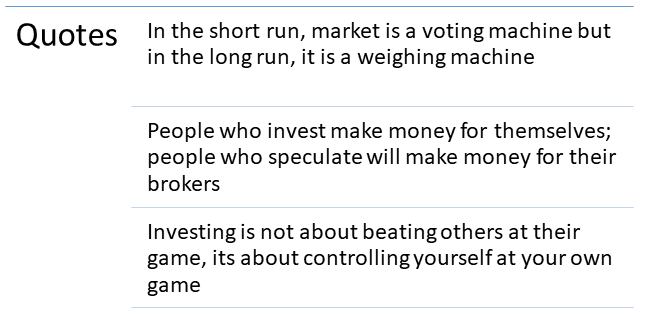

Some of the famous quotes, as stated by Benjamin Graham, are as follows:

Peter Lynch

- Peter Lynch was born in 1944, and by the age of 46, he decided to retire.

- Over the course of 13 years, he managed the Fidelity Magellan Fund, whose assets grew from $20 million to $14 billion.

- Peter picked the investment strategy that suited the nature of the asset.

- His famous quote, “only invest in what you understand," has urged many investors to follow this as their very own strategy.

- He believed that the average investor should stick with companies that they will understand well.

- He was an investor, so he knew about the market as well as its volatility.

- He could also quote the reasons behind his purchase.

- He also stated that your portfolio should only have those assets that you can understand completely.

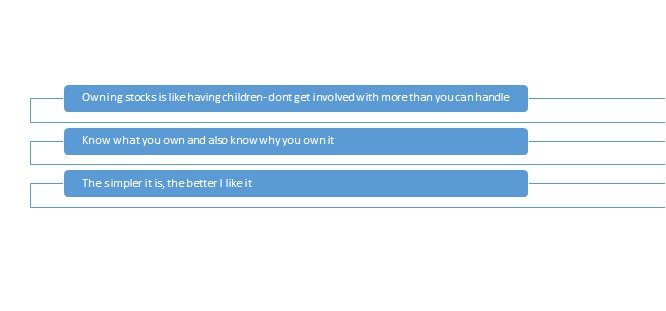

Some of the famous mantras, as stated by Peter Lynch, are as follows:

Warren Buffet

- Warren Buffet is known as the world’s greatest investor because of his trading principles.

- His investing strategies, values, and principles have also helped many investors make good investment decisions.

- His approach to “long-term value investing” comes from the old-school principles as described by Benjamin Graham.

- When we talk about value trading, an investor will buy an asset at a low price and then sell it at a high price.

- Value investing as a strategy is very important because you will learn more about a particular sector and you will also be able to determine the real value of an asset.

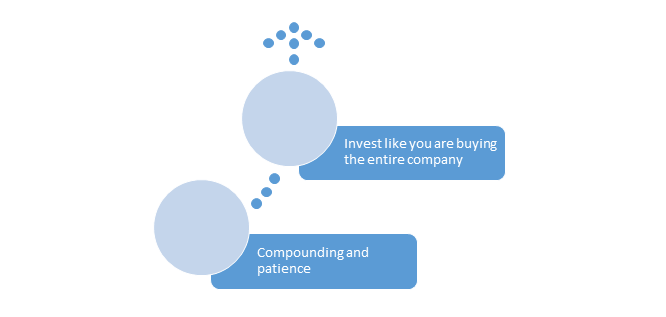

Famous investment quotes, as stated by Warren Buffet, are as follows:

Philip Fisher

- Philip Fisher was born in 1907 and was known for his famous book, “Common Stocks and Uncommon Profits.”

- His investment strategy stated buying stocks of companies with strong management teams as well as strong growth prospects.

- In 1955, he purchased the shares of Motorola, which he saw as a company with high growth potential.

- He continued to own the shares of this company until his death in 2004.

- This can be a classic example of an investor’s commitment to long-term investing.

- He also believed in the strength of high-quality growth stocks and stayed invested for the long term.

- He mainly focused on the growth stocks of large and small companies.

- As per his strategy, the growth stocks of young companies will offer the greatest possibility of gain.

- It is also possible that the gains can mount up to several thousand percent in a decade.

- He would also rely on his personal connections, which he used as a business grapevine.

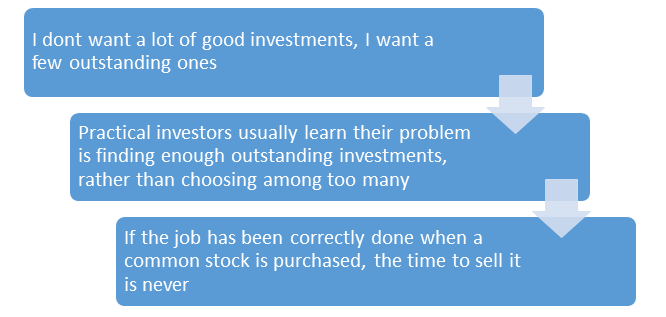

Some of the famous quotes by Philip Fisher are as follows:

George Soros

- George is considered to be the most successful investor of all time.

- In 1973, he formed a hedge fund company named Soros Fund Management, which later evolved into a well-known quantum fund.

- He is a short-term speculator.

- He specializes in bonds and currencies.

- In the past, he has also turned broad economic trends into highly leveraged plays.

- One of his most famous investment strategies states, “Look forward.”.

- He is a strong believer in exploring the future instead of looking at the past.

- As per him, you will need to visualize 18 to 24 months from now and how the securities might trade during that time.

- His main advice is to look at the company’s future earnings.

Some of the famous quotes, as stated by George Soros, are as follows:

Conclusion

In short, there are no secret mantras to invest in, but all you will need is persistence and patience, as well as good learning.

Frequently Asked Questions (FAQs)

Q1) Who is the world’s most famous investor?

Warren Buffet is the world’s most famous investor.

Q2) Who is the No. 1 investor in India?

R.K. Damani is the No. 1 investor in India.

Q3) What is a silent investor?

A silent investor is one who will invest in the company without being involved in its daily operations.

Q4) Who is called an investor?

An investor is an individual who puts money into an entity, such as a business, for a financial return.

Q5) Who is the intraday king?

The king of intraday is Rakesh Jhunjhunwala.

About Us

Nifty Trading Academy is our academy, where we teach you about the stock market and its technical analysis. We also upload blogs for the same and to enhance knowledge on the stock market. Keep reading our blogs.